“Dow Jones Intraday Trading Analysis | Market Structure & Volatility”

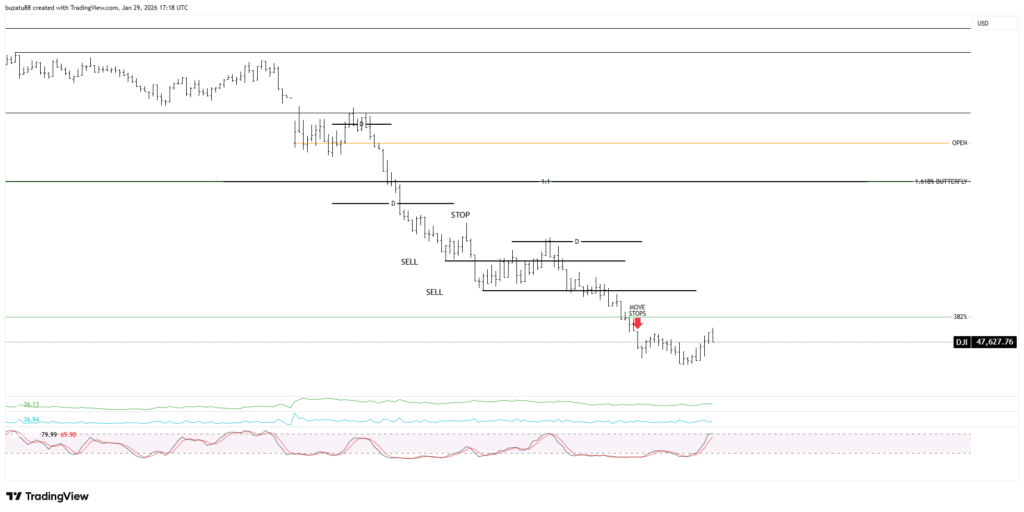

This Dow Jones intraday trading analysis documents how I approached a volatile market session using structure rather than prediction. The market opened with increased volatility, and my focus was on how the price reacted around key retracement levels, ABCD patterns, and the average true range. I was not interested in guessing direction but in observing what the market was doing and responding accordingly.

Throughout the session, I paid close attention to false breaks, overbalance, and how the price behaved around support and resistance. Entries were taken only when the structure aligned, and stops were adjusted as the market provided confirmation. While profits were made, there were moments when I questioned whether stops were moved too aggressively. This breakdown is not about perfection, but about execution, discipline, and learning from the decisions made in real time.

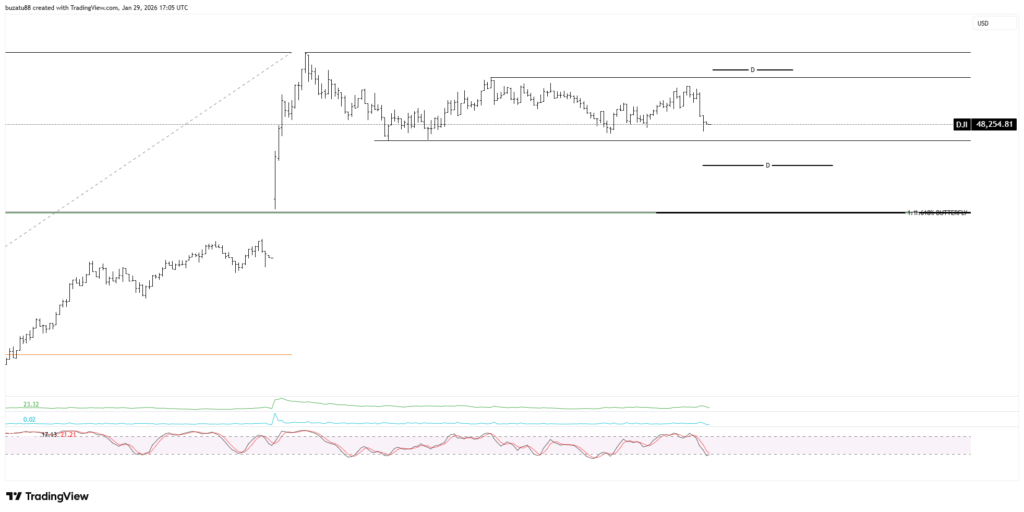

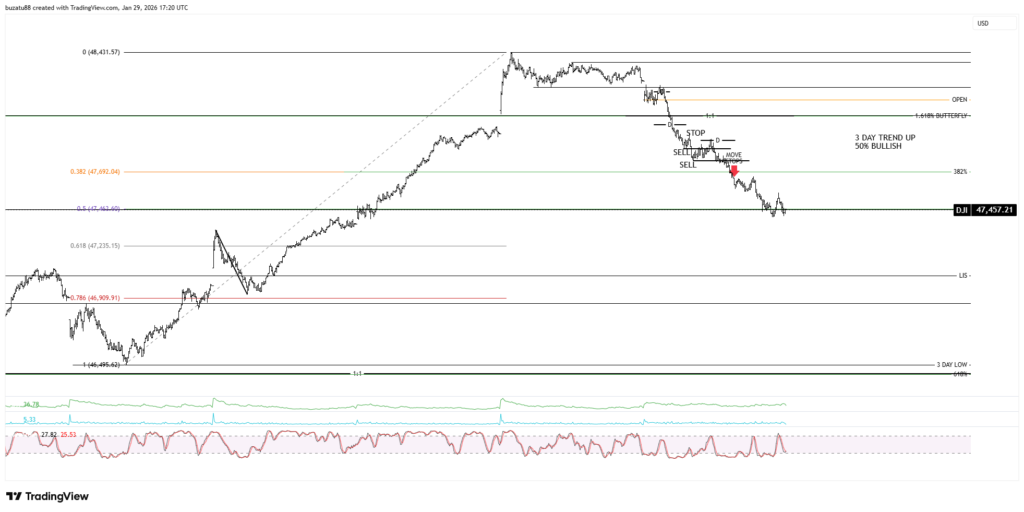

On the 13th of November 2025, the Dow Cash market fell 843 points. About 300 points more than the average at the time, and stopped at the major 50% retracement, which provided support. This pattern here is showing me, based on my research, that a continuation is possible of at least half the points of the 13th of November daily bar. I will have to wait and see…

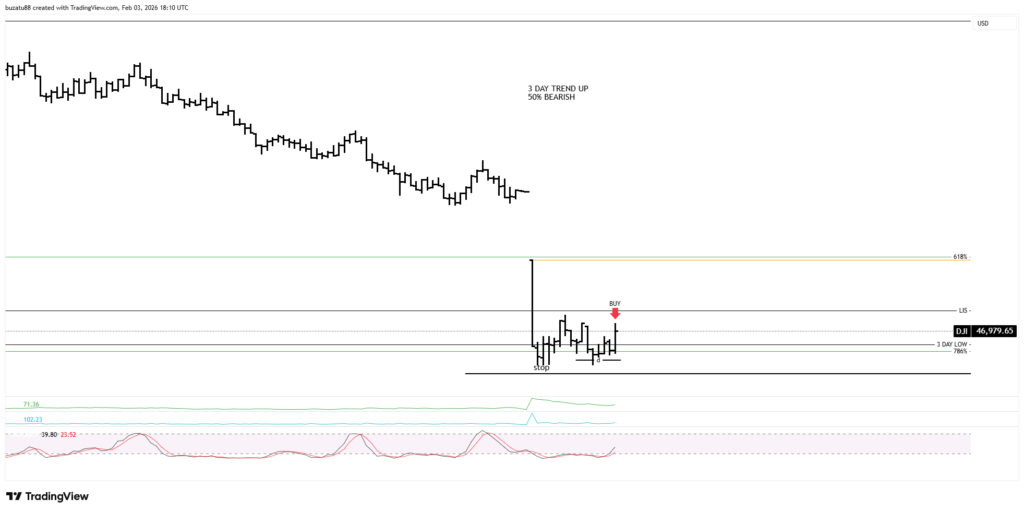

The 3-day medium trend at 46,934 is still up, but from a stochastic point of view is overbought. And the 50% support has been breached slightly. In my opinion, right now the market will move lower, but I have to wait and see what signs I will receive once the market opens.

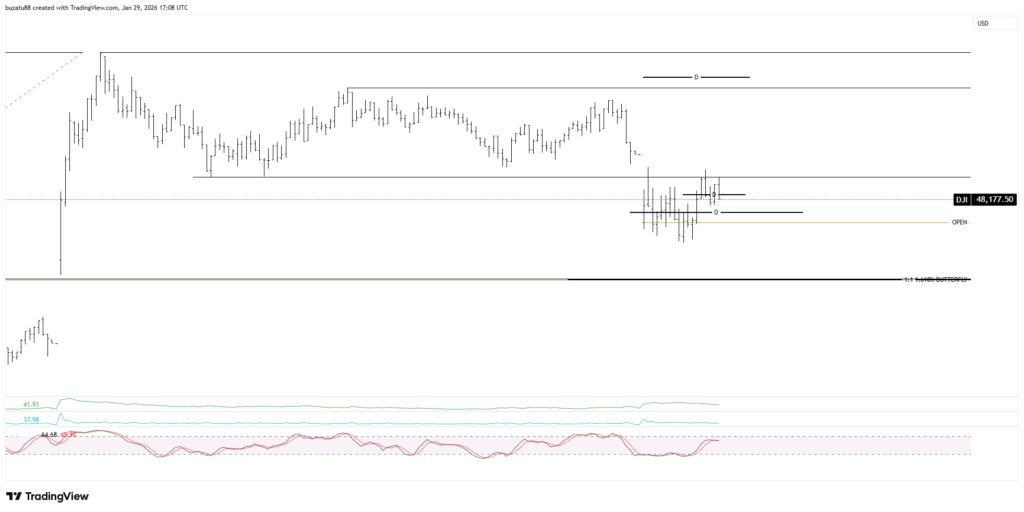

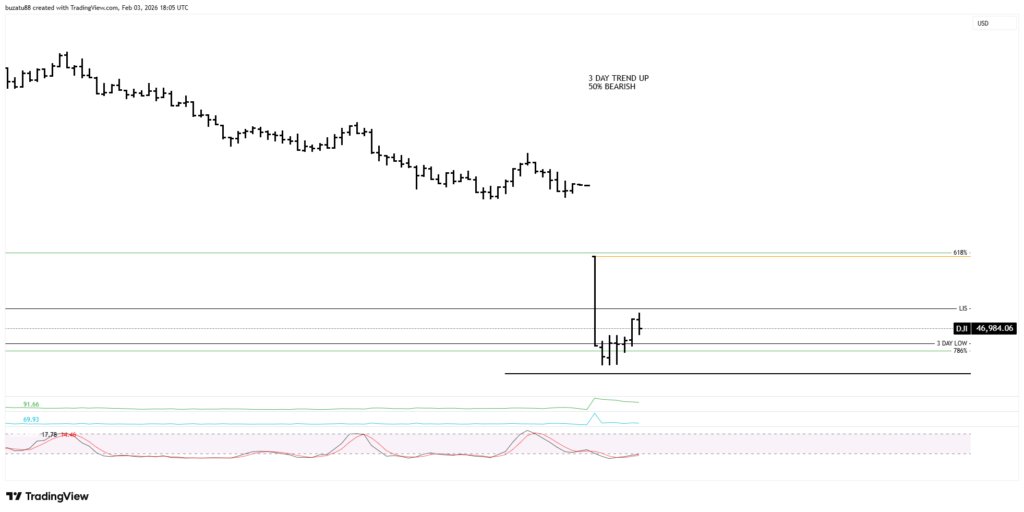

The market has opened on a gap down below the 618% 500 points down, and the average true range is 580 points. Right now, it has made a false break of the 3-day low and 786% and did not overbalance the 1:1 with the previous correction. This is a buy signal in my book, but I will wait for further confirmation.

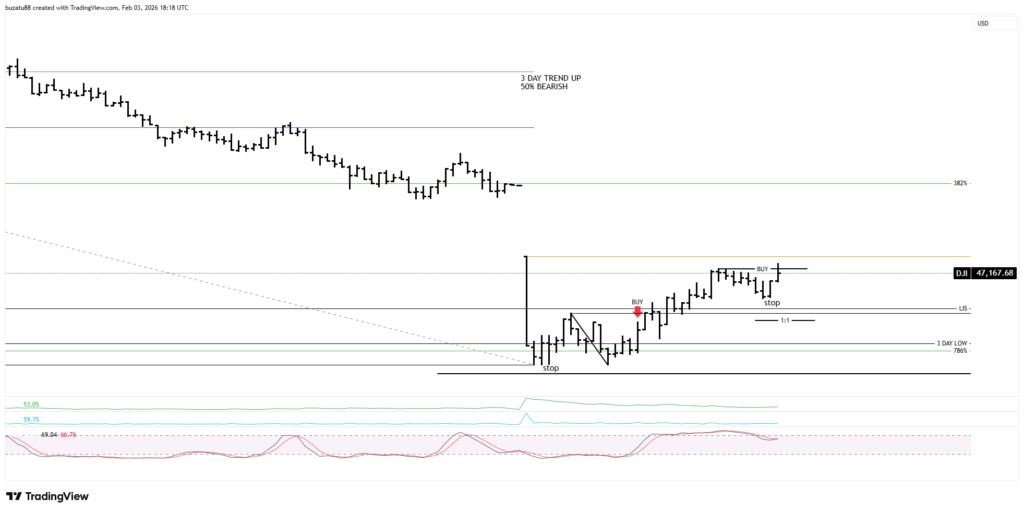

We now have a small ABCD into a double bottom in 786%, and the ATR has been taken out by 18 points. I will buy 3 points above this 15:15 bar and put a stop 3 points below the range

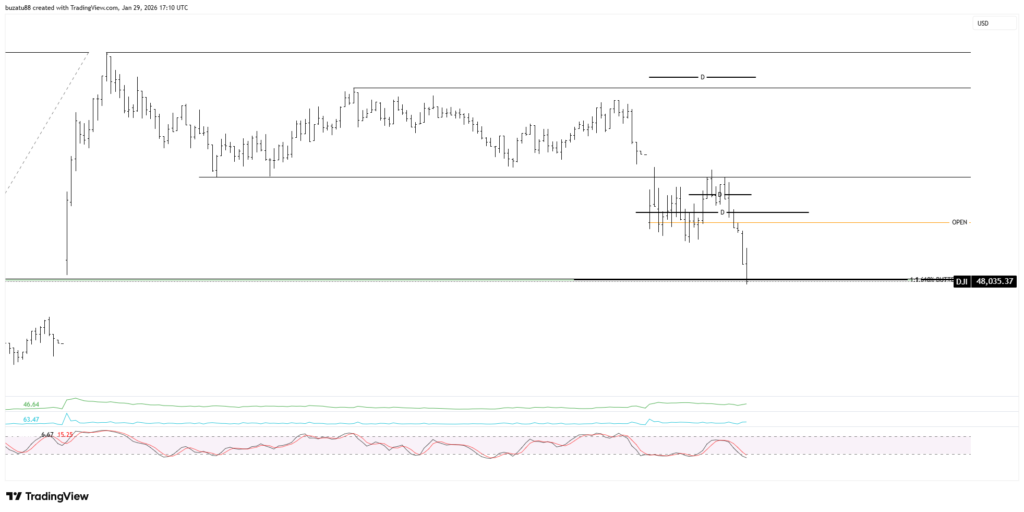

The market pushed above the ABCD and LIS resistance, which is a good sign for now. Not a strong move up, though. I have moved stop to breakeven.

I have added to the position on a breakout

I have moved both stops up

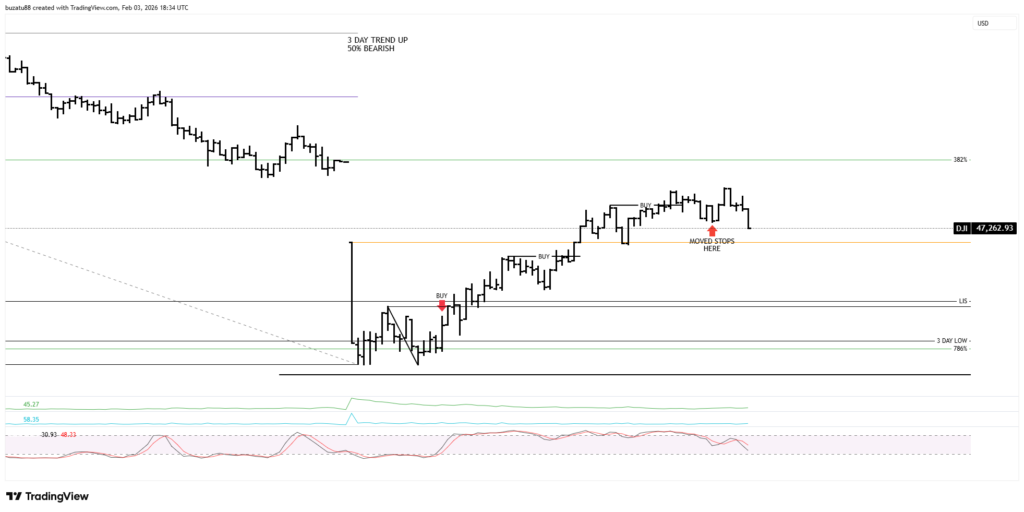

I HAVE ADDED ONE MORE TIME

I have moved my stops up, and I am waiting to see if it will reach the 382%, which is at yesterday’s close

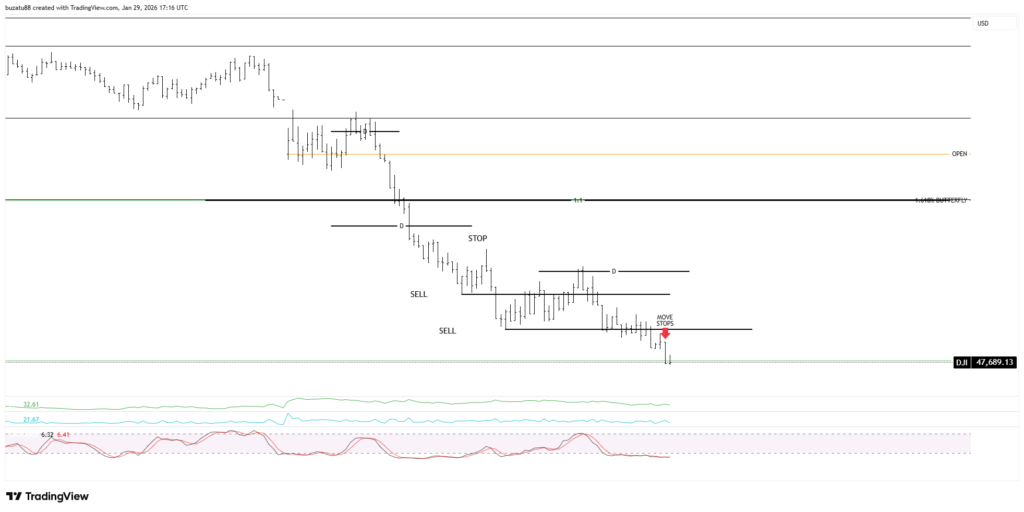

And the 15:48 bar has taken me out. First trade +267p, second trade +92p, third trade has lost me -53p. For a total of +306p. I could have stayed longer in the market, but I was afraid my profit would be much reduced. So, I moved my stops up and took a good profit. I am pleased with the outcome, but I can’t shake the feeling that I should have waited a bit longer and not moved the stops so close

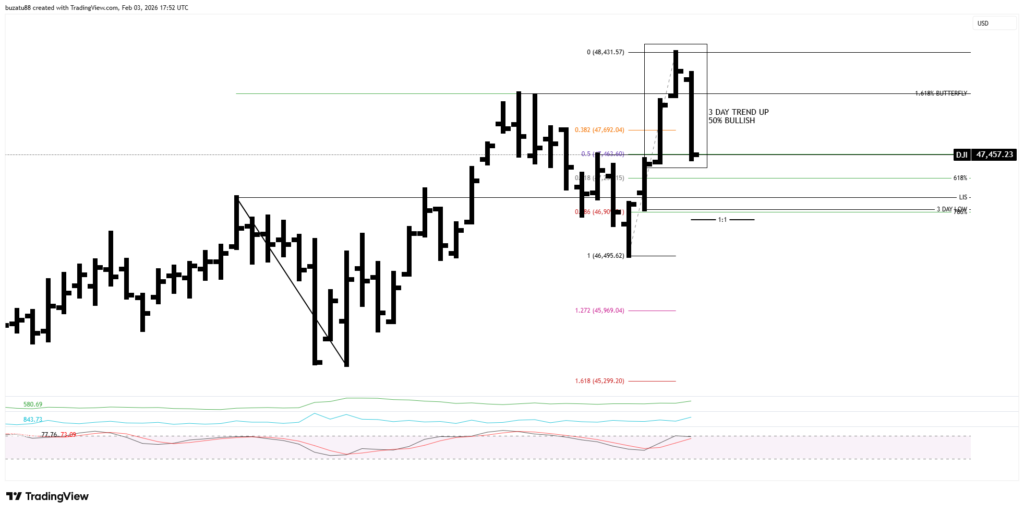

Right now, I am pleased that I have exited the market because I would have been stopped out at a much lower profit. This is interesting, though, because we have made an ABCD balanced retracement a few points above the 382% of the whole move, which is right at a known support level, and the market has closed up. This suggests a long again. The only thing I don’t like is that it has overbalanced the 170 points of the last correction.

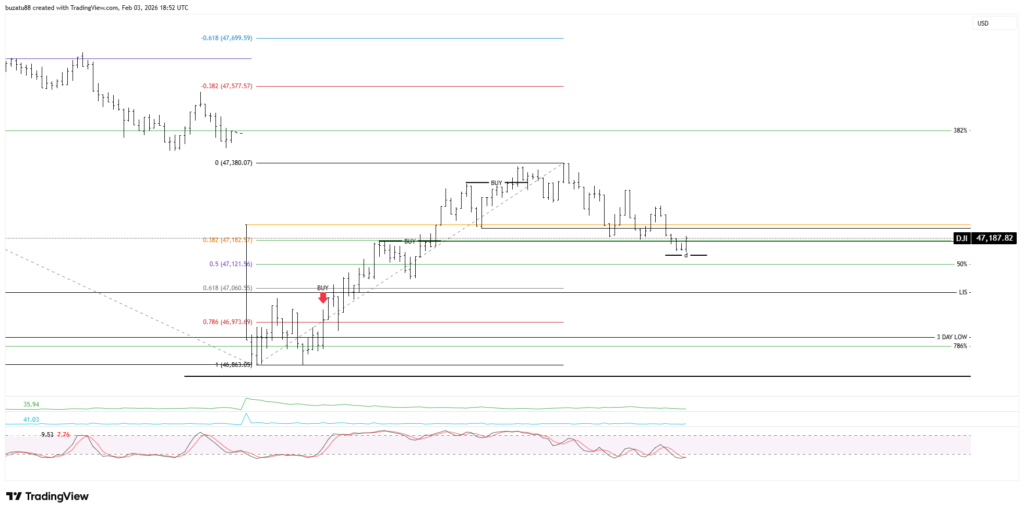

That trade would have been a loss if I had gone long. I will stop trading for the day. I am pleased with the profit

It has gone up 517 points. It is now 18:48, and I can see two possibilities…

Given that the market is at a 382% RET paired with support and an ABCD, it has a chance to go and reach yesterday’s closing, where incidentally the big 382% of the past two days is. Or because we have gone up so much, we might see a trading range up until closing. I am more in favour of the trading range scenario, so let’s see

This is what happened next… The 3-day low has held, and the market has closed above the 50%, so it is still in a strong position. The daily bar is a doji bar. A down bar followed by a doji bar in my research suggests the next-day bar should be bullish. We will just have to wait and see

“Dow Jones Intraday Trading Analysis | Market Structure & Volatility” Read More »